Monetizing everything

From flat rate to pay-as-you-go.

How likely? How soon? What impact?

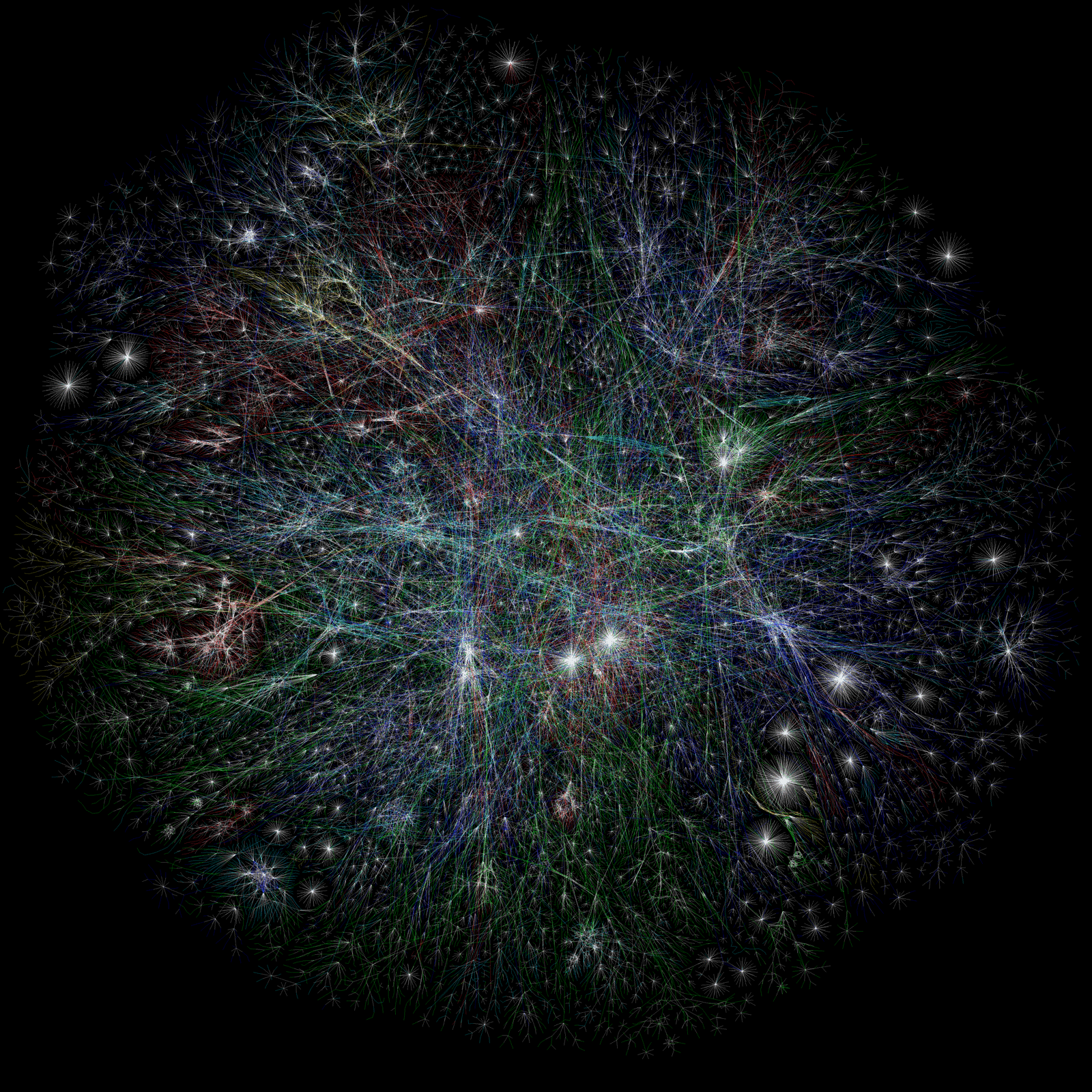

The past 50 years have seen a marked shift in approaches to regulating commons. Regulatory regimes organized around constraining bad behavior have been systematically converted to market-based approaches that focus on incentivizing good behavior. Technology is enabling this transformation of commons into property markets. And this trend is informing new takes on old urban problems. As capabilities to digitally measure, model, represent, and exchange markers of ownership and value become more powerful, huge swaths of the urban realm will be captured, encoded, and traded by investors—from street space to the ecosystem services provided by parks.

The opportunity for aligning markets with public policy is enormous. Externalities can be priced in, and overlooked or under-valued assets that were given away for free in the past can be protected and allocated more fairly and effectively. Yet the opportunities for windfalls and worsening inequality are endemic to these turbo-powered financialization processes. Corruption can creep in when property owners, local governments, and other powerful interests align to design markets and market regulations. Whether such schemes unlock the shared value of commons for all, or bring about wholesale privatization of public assets and benefit streams will depend on the details of the mechanisms put in place. The design and operation of these systems will need to be made as transparent as possible.

Signals

Signals are evidence of possible futures found in the world today—technologies, products, services, and behaviors that we expect are already here but could become more widespread tomorrow.

Key Dimensions

- Certainty: attainable

- Time Frame: later (3 to 7 years)

- Impact: disruptive

..png)